“Sometimes it becomes complicated to calculate GST Returns manually with numerous sales/purchases bills.”

About New Castle Knitwears

Recognized in the woolen industry, New Castle Knitwears was established in 1992 in Ludhiana as a woolen manufacturing company. It already has 500+ retail outlets in more than 200 cities pan India with its roots in Ludhiana, Punjab. New Castle Knitwears has a proficient team of 300 people and has a turnover of around Rs 50 crore annually.

Being the manufacturers of woolen clothing, they were working seasonal which required management in their inventory processes & financial accounting for short spans.They have already automated their inventory processes, but they needed a proper system for accounting when it comes to managing sales & purchases.

The challenge

One of the core issues New Castle Knitwears faced was to manage their sales/purchases bills in between their seasons. Being a Woolen manufacturing company, their season is generally of around 3-4 months which means heavy production, supply, and accounting in a short span of time. They were facing difficulty putting all the financial entries on time and keeping regular records which led to a delay in GST return compilation. Also, they wanted to automate their financial accounting system so that during their season they don’t have to worry about missing a bill & can focus on delivering orders on time.

They contacted Zenscale to seek an effective and permanent solution to their recurring issues related to GST. After thorough scrutiny of their processes, discussion with the business owner, and software demonstration, our team suggested a comprehensive solution to New Castle Knitwears.

"We were facing difficulty putting all the financial entries on time and keeping regular records which led to a delay in GST return compilation."

New Castle Knitwears

Approach Followed

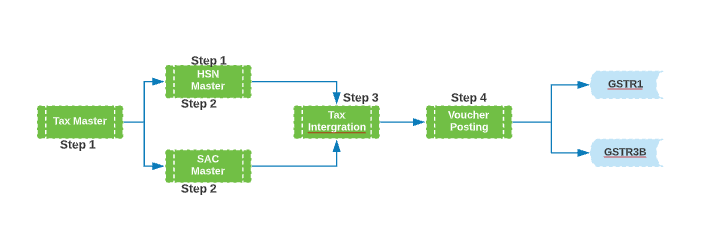

As a standard protocol, Zenscale conducted a discovery session with the business owner and suggested a detailed and easy-to-use module to New Castle Knitwears. We presented the Financial Accounting module for GST Calculation and other accounting-related matters to the company. Zenscale Financial Accounting has been tightly integrated with the GST system.

Zenscale Financial Accounting allows the user to:- Calculate & Apply Taxes through invoices automatically.

- Generate Reports for monthly returns.

- File returns through the software

- Manage the bills online

- Maintain accurate records & compliances

- Save Time & enhances productivity.

Result

With our Financial Accounting module, we solved their core automation issue. Being a cloud-based software, we automated their processes by providing a complete system to the company. Not only managing accounts, they can also generate their bills online, file returns through the software, maintain and download monthly, quarterly, or yearly reports automatically. In addition, they can now scrutinize their reports, manage HSN summary, and download the reports for their ease. With Financial Accounting, they can perform entries and analyze finances, taxes in a single click.