“Filing GST Return manually and Generating Reports every month is such a time-consuming & tedious task.”

Dan Logitech is a Laboratory Instrument company from the house of Glassco group of companies, one of the leading manufacturing companies in the scientific glassware field from India, having a presence in over 83 countries across the World.

Established in 2014, Dan Logitech has grown vastly, having its presence in more than 27 countries through channel outlets, networking, international dealers, and have a broad customer base worldwide. Glassco Laboratory Instruments Pvt Ltd came up with Dan Logitech to manufacture cost-effective European designed products, including Analytical instruments, laboratory and industrial fluid handling products, instrumentation, and other equipment. Dan Logitech is an SME with a turnover of Rs 10 crores having around 100 employees working in different locations serving clients worldwide. It also deals in products for heating, mixing, crushing, and distilling applications used by the top development houses and laboratories.

The challenge

Being a widespread company, Dan Logitech was facing significant issues in managing their taxes, especially GST. For Goods and Service Tax, there is a proper procedure every business owner has to follow and has to fill some forms as per the government norms.

- Unable to track the production stage of the finished product.

- Difficulty in maintaining the stock level in the warehouse.

- While preparing excel, sometimes wrong figures are entered leading to incorrect orders & confusion in the production process.

- Multiple Orders of the same product create chaos for the team & the vendors.

- Unable to make changes in the Bill of Material.

Struggling with these issues, Bell Fluid Technics Pvt Ltd decided to automate its processes to plan, analyze, and control in a better manner. They approached Zenscale for their queries & post need analysis session; our team suggested appropriate solutions.

"We follow the standard procedure to file the GST Return, but we want to automate the process because it is time-consuming and challenging to file manually."

Sameer Jain, Managing Diretor

Dan Logitech

To file GST Return

- Usually, the user has to prepare GSTR1, GSTR3B both.

- Fill Sales Report, Purchase report, Financial reports, i.e., Trial Balance, Profit & Loss Account and Balance sheet.

- Show Receivables & Payables based on an invoice.

- Reconcile GSTR2A in software.

Dan Logitech also follows the same procedure to file the GST Return, but they wanted to automate the process because it is time-consuming and challenging to file manually. They shared their problems stating:

- There are numerous sales and purchase bills of inventory that need to be maintained to file the GST, but it is hard to retain them, and unfortunately, some of them get misplaced.

- Errors occur while inputting the data manually due to which the wrong GST is calculated which increases the chances of penalty as per the Government Norms.

- It is tough to maintain HSN Summary manually since there are different HSN codes for every product.

- Companies have to make sure that the report contains accurate information because if the government finds anything wrong upon verification, it will be considered an offense, and you’ll be penalized.

Dan Logitech wanted to use a system that calculates GST in an online automated manner so that trials and errors can be reduced & efficiency can be increased. So they contacted Zenscale for a permanent solution to their accounting chaos.

Approach Followed

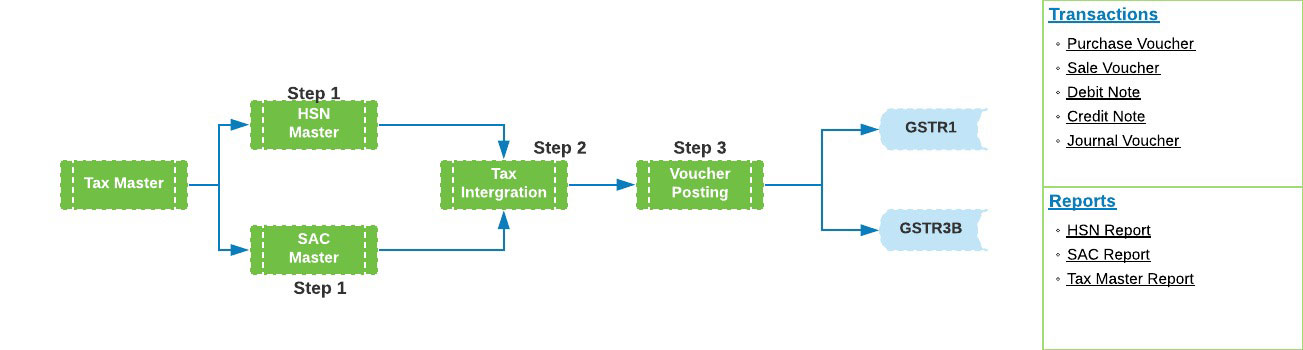

Zenscale conducted a discovery session with the business owner and suggested a comprehensive module to Dan Logitech. We presented the Financial Accounting module for GST Calculation and other accounting-related matters to the company. Zenscale Financial Accounting has been tightly integrated with the GST system.

Zenscale Financial Accounting allows the user to:- Calculate & Apply Taxes through invoices automatically.

- Generate Reports for monthly returns.

- File returns through the software

- Manage the bills online

- Maintain accurate records & compliances

- Save Time & enhances productivity.

Result

Through Cloud-Based Financial Accounting, we automated their processes by providing a summarised system to the company. They can now generate their bills online, file returns through the software, develop monthly, quarterly, or yearly reports automatically, and maintain accurate records. In addition, they can now scrutinize their reports, manage HSN summary, and download the reports for their ease. With Financial Accounting, they can perform entries and analyze finances, taxes on their fingertips.